Multiple Choice

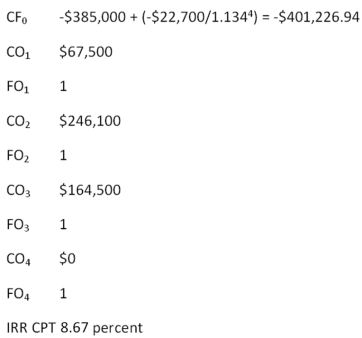

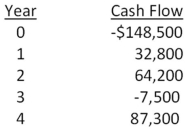

-Cool Water Drinks is considering a proposed project with the following cash flows.Should this project be accepted based on the combined approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 12.6 percent? Why or why not?

A) Yes;The MIRR is 8.81 percent.

B) Yes;The MIRR is 9.23 percent.

C) No;The MIRR is 8.81 percent.

D) No;The MIRR is 9.06 percent.

E) No;The MIRR is 9.23 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Southern Chicken is considering two projects.Project A

Q37: Which one of the following is an

Q38: Which one of the following methods determines

Q57: The length of time a firm must

Q60: When the present value of the cash

Q67: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -A project produces

Q71: The Square Box is considering two projects,both

Q89: An investment project has an installed cost

Q104: Which one of the following methods of

Q107: Mutually exclusive projects are best defined as