Multiple Choice

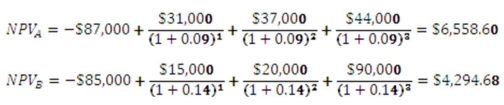

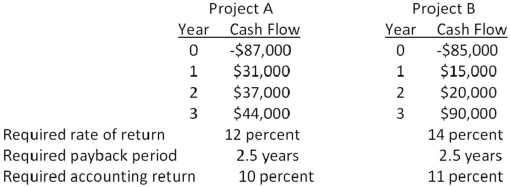

-You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.

Should you accept or reject these projects based on IRR analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on internal rate of return analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Samuelson Electronics has a required payback period

Q67: Which of the following are considered weaknesses

Q73: The profitability index is most closely related

Q74: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are analyzing

Q78: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are considering

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -Based on the

Q89: An investment project has an installed cost

Q90: Which one of the following statements related

Q108: Which one of the following correctly applies

Q115: Net present value:<br>A)is the best method of