Essay

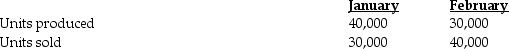

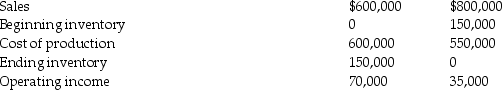

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up.Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5,and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences.How would variable costing income statements help the manager understand the division's operating income?

Correct Answer:

Verified

The 10,000 units in inventory being assi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Beginning inventory + cost of goods manufactured

Q35: Practical capacity rather than master-budget volume is

Q60: Which of the following assumes that capacity

Q70: Using master budget capacity as the denominator

Q76: The breakeven points are the same under

Q90: Under variable costing, lease charges paid on

Q100: Raul Technologies is concerned that increased sales

Q133: Which of the following statements is true?<br>A)

Q191: Aspen Popular Company prepared the following absorption-costing

Q198: Answer the following question using the information