Short Answer

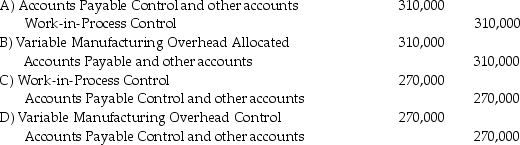

Marshall Company uses a standard cost system.In March,$270,000 of variable manufacturing overhead costs were incurred and the flexible-budget amount for the month was $310,000.Which of the following variable manufacturing overhead entries would have been recorded for March?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Tightly budgeted machine time standards can lead

Q25: When fixed overhead spending variance is unfavorable,

Q44: Favorable overhead variances are always recorded with

Q62: Bismith Company reported:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5540/.jpg" alt="Bismith Company reported:

Q63: Russo Corporation manufactured 21,000 air conditioners

Q68: Davidson Corporation manufactured 52,400 units during

Q70: Radon Corporation manufactured 37,500 units during March.The

Q72: J&J Materials and Construction Corporation produces

Q106: Possible reasons for the larger actual materials-handling

Q118: Computing standard costs at the start of