Multiple Choice

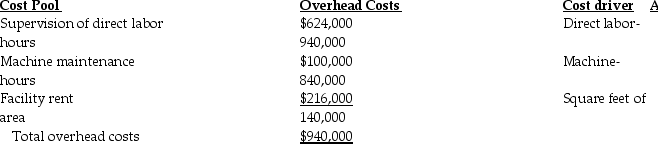

Milan Company has identified three cost pools to allocate overhead costs.The following estimates are provided for the coming year:

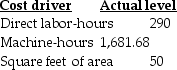

The accounting records show the Mossman Job consumed the following resources:

Under activity-based costing,what is the amount of machine maintenance costs allocated to the Mossman Job? (Do not round any intermediary calculations. )

A) $1,881.88

B) $200.20

C) $1,681.68

D) $210.45

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Johnson Superior Products Inc. produces hospital equipment

Q26: When allocating the total indirect cost pool

Q55: Using department indirect-cost rates to allocate costs

Q108: ABC and traditional systems are quite similar

Q143: Brilliant Accents Company manufactures and sells three

Q147: North Street Corporation manufactures two models of

Q149: High Traffic Products Corporation has two departments,Small

Q150: Xylon Corp.has contracts to complete weekly supplements

Q151: Dartmouth Corporation manufactures two models of office

Q175: _ are the costs of activities undertaken