Multiple Choice

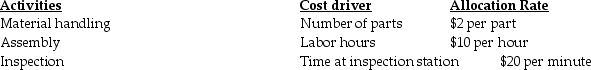

Nichols Inc.manufactures remote controls.Currently the company uses a plant-wide rate for allocating manufacturing overhead.The plant manager is considering switching-over to ABC costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $600 per labor hour.

What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 100 remote controls are produced? The batch requires 460 parts,5 direct manufacturing labor hours,and 18 minutes of inspection time.

A) $6.00 per remote control

B) $13.30 per remote control

C) $32.00 per remote control

D) $1,330.00 per remote control

Correct Answer:

Verified

Correct Answer:

Verified

Q38: _ is considered while choosing a cost

Q55: Stark Corporation has two departments,Car Rental and

Q56: Dartmouth Corporation manufactures two models of office

Q62: With traditional costing systems, products manufactured in

Q99: For each of the following activities identify

Q100: Which of the following statements is true

Q107: Demand for refinements to the costing system

Q109: Only indirect costs are included in the

Q140: A single indirect-cost rate distorts product costs

Q152: Which of the following reasons explain why