Multiple Choice

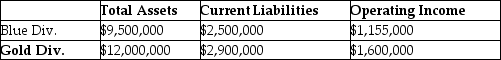

Stonex Corp,whose tax rate is 35%,has two sources of funds: long-term debt with a market value of $6,200,000 and an interest rate of 9%,and equity capital with a market value of $14,000,000 and a cost of equity of 13%.Stonex has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

Calculate EVA for the Gold Division.(Round intermediary calculations to four decimal places. )

A) -$56,290

B) $56,290

C) $1,040,000

D) $983,710

Correct Answer:

Verified

Correct Answer:

Verified

Q4: An important element in designing accounting-based performance

Q36: Bob's Cellular Phone Company uses ROI to

Q56: The top management at Amore Corp,a manufacturer

Q59: Care Inc. ,has two divisions that operate

Q68: In an EVA calculation, the corporate charge

Q100: Companies that adopt the EVA concept define

Q101: Discuss the issues and complications that may

Q103: The required rate of return multiplied by

Q124: Vega Corp's corporate income has declined to

Q132: In an EVA calculation, the measure of