Multiple Choice

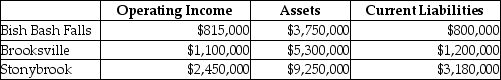

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $19,000,000 issued at an interest rate of 11%,and equity capital that has a market value of $7,000,000 (book value of $5,000,000) .Coldbrook Company has profit centers in the following locations with the following operating incomes,total assets,and current liabilities.The cost of equity capital is 16%,while the tax rate is 35%.

What is the EVA® for Brooksville? (Round intermediary calculations to four decimal places. )

A) $715,000

B) $390,730

C) $166,179

D) $324,270

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following steps in designing

Q28: The weighted-average cost of capital (WACC) equals

Q40: An additional criticism of team-based compensation is

Q58: The DuPont method recognizes the two basic

Q80: Waldorf Company has two sources of funds:

Q81: Which of the following is the expression

Q83: The top management at Amore Corp,a manufacturer

Q89: To calculate the value of fixed assets

Q94: Ventaz Corp. purchased assets for its overseas

Q138: What targets should companies use, and when