Essay

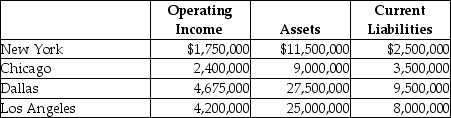

Coptermagic Company supplies helicopters to corporate clients.Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%,and equity capital that has a market value of $18 million (book value of $8 million).The cost of equity capital for Coptermagic is 15%,and its tax rate is 30%.Coptermagic has profit centers in four divisions that operate autonomously.The company's results for 2015 are as follows:

Required:

a.Compute Coptermagic's weighted average cost of capital.

b.Compute each division's Economic Value Added.

c.Rank the divisions by EVA.

Correct Answer:

Verified

a.WACC = [(.10 × (1 - .30)× $32,000,000)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Which of the following steps in designing

Q18: "Levers of control," in addition to a

Q27: When managers set and measure target levels

Q40: An additional criticism of team-based compensation is

Q52: A company which favors the residual income

Q58: The DuPont method recognizes the two basic

Q102: The proponents of using net book value

Q143: Reducing the investment base to improve ROI

Q145: Which of the following best describes an

Q146: Craylon Corp. is planning the 2018 operating