Essay

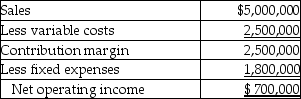

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions.The division managers are evaluated,in part,on the basis of the change in their return on invested assets.Operating results for the Packer Division for 2018 are budgeted as follows:

Operating assets for the division are currently $3,600,000.For 2018,the division can add a new product line for an investment of $600,000.The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually.Variable costs of the new product will average 60% of the selling price.

Required:

a.What is the effect on ROI of accepting the new product line?

b.If the company's required rate of return is 6% and residual income is used to evaluate managers,would this encourage the division to accept the new product line? Explain and show computations.

Correct Answer:

Verified

a.

_TB5540_00_TB5540_00 Current ROI = $...

_TB5540_00_TB5540_00 Current ROI = $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: ROI, RI, or EVA measures are more

Q28: The weighted-average cost of capital (WACC) equals

Q81: Which of the following is the expression

Q82: Executive compensation plans are based on both

Q83: The top management at Amore Corp,a manufacturer

Q90: Antique Corp uses the investment center concept

Q91: The top management at Amore Corp,a manufacturer

Q94: Ventaz Corp. purchased assets for its overseas

Q97: All of the following are ways to

Q138: What targets should companies use, and when