Multiple Choice

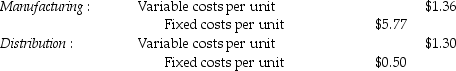

Timekeeper Corporation has two divisions,Distribution and Manufacturing.The company's primary product is high-end watches.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,009,000 units a week and usually purchases 2,004,500 units from the Manufacturing Division and 2,004,500 units from other suppliers at $13.00 per unit.

Assume 110,000 units are transferred from the Manufacturing Division to the Distribution Division for a transfer price of $8.00 per unit.The Distribution Division sells the 110,000 units at a price of $18 each to customers.What is the operating income of both divisions together?

A) $347,600

B) $392,150

C) $997,700

D) $634,700

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A benefit of using a market-based transfer

Q13: In markets that are not perfectly competitive,

Q17: Division A sells ground veal internally to

Q38: The cost used in cost-based transfer prices

Q59: Which of the following best describes an

Q99: Branded Shoe Company manufactures only one type

Q102: Plish Company manufactures only one type of

Q113: In a management control system, which of

Q117: Effort in terms of management control systems

Q128: TrueValue Company makes all types of office