Multiple Choice

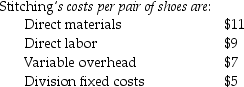

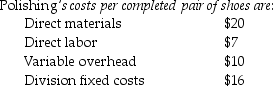

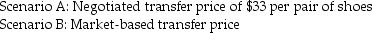

Branded Shoe Company manufactures only one type of shoe and has two divisions,the Stitching Division and the Polishing Division.The Stitching Division manufactures shoes for the Polishing Division,which completes the shoes and sells them to retailers.The Stitching Division "sells" shoes to the Polishing Division.The market price for the Polishing Division to purchase a pair of shoes is $50.(Ignore changes in inventory. ) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-103,000 units.The fixed costs for the Polishing Division are assumed to be $22 per pair at 103,000 units.

Calculate and compare the difference in overall corporate net income of Branded Shoe Company between Scenario A and Scenario B if the Assembly Division sells 103,000 pairs of shoes for $120 per pair to customers.

A) $1,751,000 more net income under Scenario A

B) $1,751,000 less net income using Scenario B

C) $103,000 less net income using Scenario A.

D) The net income would be the same under both scenarios.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Briefly describe the conditions that should be

Q35: Dual pricing insulates managers from the realities

Q43: Effort refers to physical exertion, such as

Q62: What is decentralization and what are its

Q67: Dual pricing uses two separate transfer-pricing methods

Q106: Transfer-pricing systems enable managers to focus on

Q109: What does Section 482 of the U.S.

Q116: Which of the following is not a

Q122: For each of the following statements regarding

Q130: For each of the following Balanced Scorecard