Multiple Choice

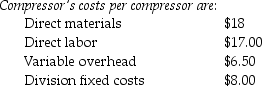

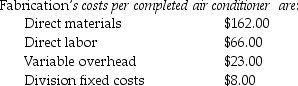

Plish Company manufactures only one type of washing machine and has two divisions,the Compressor Division,and the Fabrication Division.The Compressor Division manufactures compressors for the Fabrication Division,which completes the washing machine and sells it to retailers.The Compressor Division "sells" compressors to the Fabrication Division.The market price for the Fabrication Division to purchase a compressor is $60.00.(Ignore changes in inventory. ) The fixed costs for the Compressor Division are assumed to be the same over the range of 8000-13,000 units.The fixed costs for the Fabrication Division are assumed to be $11.50 per unit at 13,000 units.

What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the transfer price per compressor is 110% of full costs?

A) $19.80

B) $32.45

C) $47.30

D) $54.45

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Which of the following taxes does transfer

Q23: A well-designed management control system uses information

Q82: The costs used in cost-based transfer prices

Q84: Transfer prices do not affect managers whose

Q92: A company should use cost-based transfer prices

Q98: In analyzing transfer prices, the _.<br>A) buyer

Q118: For each of the following,identify whether it

Q125: Negotiated transfer prices are often employed when

Q127: Which of the following best describes a

Q142: Division A sells ground veal internally to