Multiple Choice

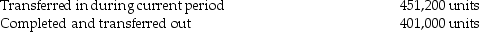

Direct Disk Drive Company operates a computer disk manufacturing plant.Direct materials are added at the end of the process.The following data were for August 2017:

Transferred-in costs (100% complete)

Direct materials (0% complete)

Conversion costs (80% complete)

Transferred-in costs (100% complete)

Direct materials (0% complete)

Conversion costs (55% complete)

Calculate equivalent units for conversion costs using the FIFO method.

A) 30,280 units

B) 353,400 units

C) 299,800 units

D) 390,580 units

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Timekeeper Inc.manufactures clocks on a highly automated

Q25: Audrey Auto Accessories manufactures plastic moldings for

Q26: Jane Industries manufactures plastic toys.During October,Jane's Fabrication

Q28: In a period of falling prices, the

Q45: Process costing would most likely be used

Q52: In calculating cost per equivalent unit, the

Q61: A major advantage of using the FIFO

Q63: The weighted-average cost is the total of

Q119: Which of the following is an assumption

Q142: Assembly department of Zahra Technologies had 200