Multiple Choice

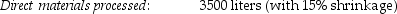

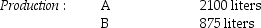

Cola Drink Company processes direct materials up to the split-off point where two products,A and B,are obtained.The following information was collected for the month of July:

The cost of purchasing 3500 liters of direct materials and processing it up to the split-off point to yield a total of 2975 liters of good products was $7000.There were no inventory balances of A and B.

Product A may be processed further to yield 2000 liters of Product Z5 for an additional processing cost of $160.Product Z5 is sold for $60.00 per liter.There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 800 liters of Product W3 for an additional processing cost of $290.Product W3 is sold for $65 per liter.There was no beginning inventory and ending inventory was 25 liters.

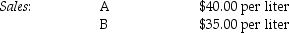

What is Product Z5's estimated net realizable value at the split-off point?

A) $51,840

B) $83,840

C) $119,840

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: The constant gross-margin percentage NRV method is

Q40: Which of the following would explain why

Q72: In joint costing, the physical measures are

Q103: What are joint costs, separable costs, and

Q119: The Green Company processes unprocessed goat milk

Q120: Torid Company processes 18,025 gallons of direct

Q125: Bismite Corporation purchases trees from Cheney lumber

Q139: Which of the following factors would guide

Q140: Which method of accounting recognizes byproducts in

Q141: The challenge of a production facility that