Multiple Choice

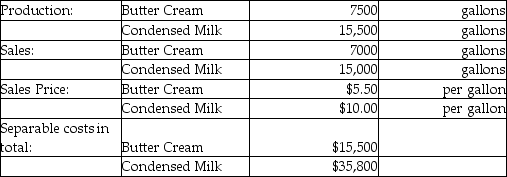

The Kenton Company processes unprocessed milk to produce two products,Butter Cream and Condensed Milk.The following information was collected for the month of June:

The cost of purchasing the of unprocessed milk and processing it up to the split-off point to yield a total of 23,000 gallons of saleable product was $48,000.

The company uses constant gross-margin percentage NRV method to allocate the joint costs of production.Which of the following statements is true of Kenton's joint cost allocations?

A) The gross margin is same for both products because constant gross margin percentage NRV method ignores profits earned before the split-off point.

B) One product can receive negative joint costs allocations to bring the other unprofitable product to the overall average gross margin.

C) Kenton has chosen the easiest method for allocating its joint costs of production.

D) The gross profit percent of condensed milk is lower than the gross profit of butter cream.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: How does the sales value at split-off

Q21: Which of the following statements is true

Q61: The Green Company processes unprocessed goat milk

Q62: The Green Company processes unprocessed goat milk

Q64: Oregon Lumber processes timber into four products.During

Q69: Zenon Chemical,Inc. ,processes pine rosin into three

Q71: The Kenton Company processes unprocessed milk to

Q88: Allocating joint costs to individual products can

Q115: Joint costs are incurred beyond the split-off

Q136: Under the benefits-received criterion, the physical-measure method