Essay

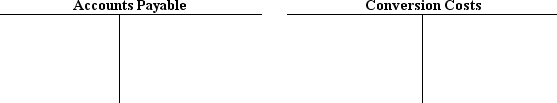

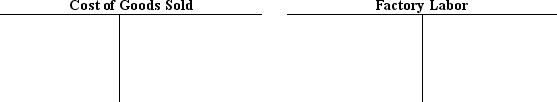

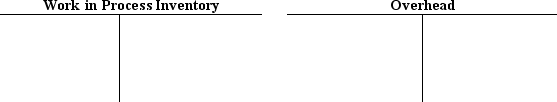

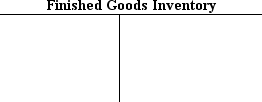

Ressano Manufacturing had the following transactions during March. There were no beginning inventory balances.

a. Purchased $96,000 of direct materials, on account.

b. Incurred direct labor costs, $83,000.

c. Applied $88,000 of overhead to production.

d. Completed units costing $252,000.

e. Sold units costing $250,000.

Using backflush costing, show the flow of costs using the T accounts below. Label each entry with the appropriate letter.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: For service organizations,customer relations are part of

Q82: When managing inventory in a just-in-time environment,

Q84: Which one of the four levels of

Q88: For a small coffee cafe, which of

Q89: Backflush costing eliminates the need for a

Q90: Define activity-based costing. Explain why this approach

Q91: Departments 4. Value-adding activities<br>A) 1 and 3<br>B)

Q129: Traditional environments emphasize functional departments that tend

Q130: Backflush costing aims at decreasing waste in

Q137: In a just-in-time environment,<br>A)production runs are interrupted