Essay

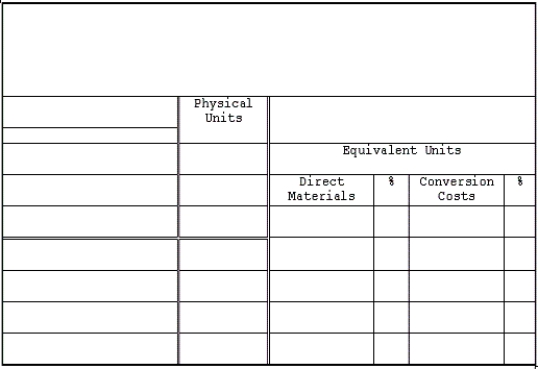

Trunkey Products, Inc., uses a process costing system and has just completed production for the month of November 20xx. The following production data were obtained from the accounting records:

a. Units in beginning inventory totaled 6,800 and were 30 percent complete as of November 1 (all direct materials were added to these products in the preceding month).

b. During the period, 156,200 units were started.

c. 19,200 units were partially completed as of November 30, 20xx.

d. Ending work in process inventory was 40 percent complete at month end.

From the data given, compute the equivalent units of production for direct materials and conversion costs for the month ended November 30, 20xx, assuming a FIFO flow of costs.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The Taylor Company uses a process costing

Q11: If a company uses a process costing

Q12: Trunkey Products, Inc., uses a process costing

Q13: Production has just been completed for January

Q14: Data for Osaka Corporation for the month

Q16: The reason for combining direct labor and

Q17: Montell Inc. produces a variety of outdoor

Q18: The FIFO approach to process costing assumes

Q19: Use the following data from a company

Q110: Weston Company uses the FIFO method in