Essay

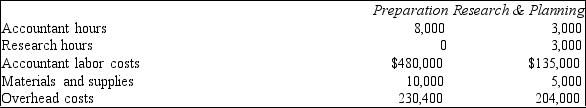

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns. The firm has five accountants and five researchers, and it uses job order costing to determine the cost of each client's return. The firm is divided into two departments: (1) Preparation and (2) Research & Planning. Each department has its own overhead application rate. The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours. The following is the company's estimates for the current year's operations.

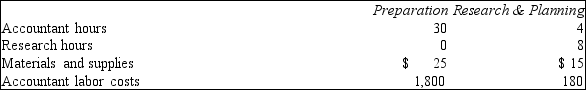

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

a. Compute the overhead rates to be used by both departments.

b. Determine the cost of Client No. 2006-713, by department and in total.

Correct Answer:

Verified

a. Preparation Department overhead rate ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The following partially completed T accounts summarize

Q7: Which of the following could not be

Q8: When direct materials are issued from inventory

Q9: If the applied overhead is more than

Q11: In a job order costing system, the

Q12: Taylor Company manufactures guitars and uses

Q13: Job order cost cards for incomplete jobs

Q14: Accounting for the incurrence of _ does

Q15: Unique products are produced in a continuous

Q117: A process costing system is used by