Not Answered

Use the following information to answer the question below.

When Calvert Corporation was formed on January 1, 2010, the corporate charter provided for 50,000 shares of $20 par value common stock. The following transactions were among those engaged in by the corporation during its first month of operation:

1. The corporation issued 200 shares of stock to its lawyer in full payment of the $5,000 bill for assisting the company in drawing up its articles of incorporation and filing the proper papers with the state agency.

2. The company issued 8,000 shares of stock at a price of $25 per share.

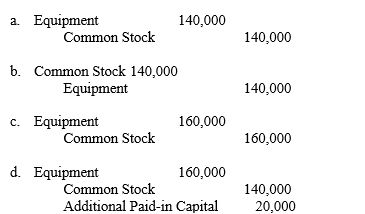

3. The company issued 7,000 shares of stock in exchange for equipment that had a fair market value of $160,000.

The entry to record transaction 3 is:

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Once an owner of convertible preferred stock

Q30: The price/earnings (P/E)ratio is a measure of

Q110: To evaluate the amount of dividends they

Q153: Cash dividends become a liability of a

Q163: The entry to record the declaration of

Q167: Treasury shares plus outstanding shares equal<br>A)unissued shares.<br>B)subscribed

Q177: Use the following information to answer the

Q178: Kagel Corporation had 30,000 shares of $5

Q182: Beckham Corporation has 3,000 shares of $100

Q185: If Willis Corporation has 80,000 shares of