Short Answer

Use the following information to answer the question below. On January 1, 2010, Falcon Corporation had 40,000 shares of $10 par value common stock issued and outstanding. All 40,000 shares had been issued in a prior period at $17 per share. On February 1, 2010, Falcon purchased 1,000 shares of treasury stock for $19 per share and later sold the treasury shares for $26 per share on March 2, 2010.

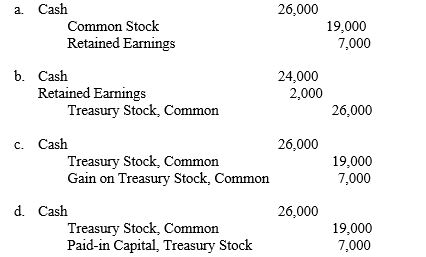

The entry to record the sale of the treasury shares on March 2, 2010 is

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Dividends in arrears cannot exist in conjunction

Q17: If a corporation has issued common stock

Q17: Outstanding shares of stock are<br>A) authorized shares

Q18: The board of directors of Irondale Corporation

Q22: Beckham Corporation has 3,000 shares of $100

Q24: No rights or privileges are associated with

Q46: Margil Industries has 40,000 shares of 9

Q94: Legal capital is a descriptive phrase for<br>A)stockholders'

Q175: Holders of preferred stock normally do not

Q227: Dividends in arrears are dividends on<br>A) noncumulative