Essay

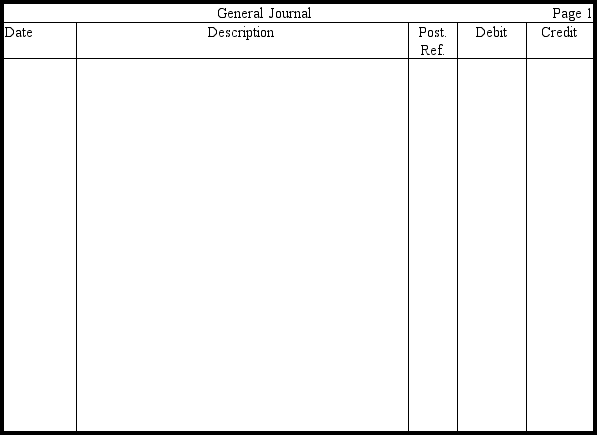

On June 1, 2008 , Will Oldman, treasurer of A-One Corporation, received an option to purchase 2,000 shares of A-One $5 par value common stock for $20 per share any time during 2009 or 2010. Oldman exercised his option on May 14, 2009. The market price of the stock was $20 per share on June 1, 2008, and $25 per share on May 14, 2009. Provide the entry in journal form to record the exercise of the option on A-One's books. Show computations. (Omit explanation.)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Once an owner of convertible preferred stock

Q110: To evaluate the amount of dividends they

Q143: The price/earnings (P/E)ratio is measured in terms

Q153: Cash dividends become a liability of a

Q170: Return on equity equals average stockholders' equity

Q171: The sale of shares in a corporation

Q172: Retained earnings consist of a pool of

Q174: Gault Corporation had the following shares of

Q177: Use the following information to answer the

Q178: Kagel Corporation had 30,000 shares of $5