Essay

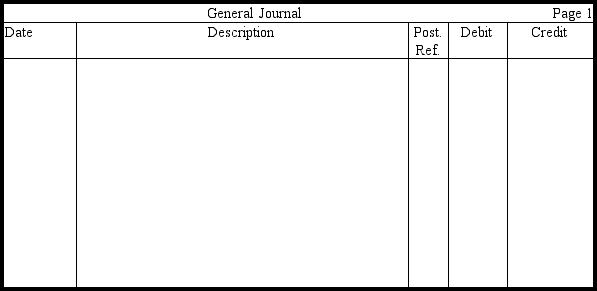

Darla Katz earns an hourly wage of $12, with time-and-a-half pay for hours worked over 40 per week. During the most recent week, she worked 46 hours, her federal tax withholding totaled $62, her state tax withholding totaled $18, and $3 was withheld for union dues. Assuming a 6.2 percent social security tax rate and a 1.45 percent Medicare tax rate, prepare the entry without explanations in the journal provided to record Katz's wages and related liabilities. Round to the nearest penny.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: If the net present value of a

Q76: Lee Provo is paid $8 per hour,plus

Q78: The amount recorded for Payroll Taxes and

Q82: Use this information to answer the

Q83: Use this information to answer the

Q86: Use this information to answer the

Q91: A commitment is a legal obligation that

Q98: Which of the following descriptions would not

Q169: Accrued liabilities often arise as a result

Q174: Property Taxes Expense is recorded only in