Essay

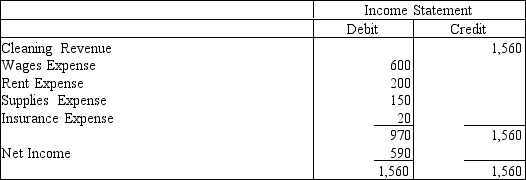

Prepare closing entries for December without explanations from the following Income Statement columns of the work sheet of Duffy Cleaning Service, assuming that a $250 owner withdrawal was made during the period.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Despite the many uses of microcomputers,they cannot

Q36: Doug Riley is the only accountant employed

Q71: The adjusting entries involving Depreciation Expense-Buildings and

Q119: Working papers provide a written record of

Q124: The only accounts that are closed are

Q129: A reversing entry could include a<br>A)debit to

Q168: During the closing process, revenues are transferred

Q170: The owner's Capital, Withdrawals, and Income Summary

Q175: Use the following adjusted trial balance to

Q176: Financial statements cannot be prepared correctly until