Multiple Choice

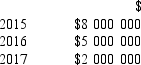

On 1 January 2015,Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B.The light rail was to be built over three years,with progress payments of $7 000 000 to be made at the end of each year.Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:  The project was completed in December 2017.

The project was completed in December 2017.

-Using the completed contract method,how much profit would Romulus Ltd report in 2017?

A) $0

B) $800 000

C) $5 000 000

D) $6 000 000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Revenue should be recognised when: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6113/.jpg"

Q9: Toy Company manufactures toy koalas.Transactions for the

Q10: Junction Company had the following transactions,among others,during

Q11: Leslie Ltd has found an error in

Q12: Opec Ltd manufactures crystal balls.Transactions for year

Q14: Which of the following is NOT necessary

Q15: On 1 January 2015,Romulus Ltd signed a

Q16: The profit for a particular project of

Q17: Holidays Ltd manufactures caravans.Transactions for the year

Q18: Multi-Storey Builders Ltd had a large three-year