Multiple Choice

At 30 June 2016 Shifty Ltd had a balance of Accounts receivable of $90 000 and an Allowance for doubtful debts of $4000.It was decided to write off the debt of Wriggler,totalling $2500,as irrecoverable.It was further decided that the Allowance for doubtful debts should stand at 5 per cent of Accounts receivable.What was the journal entry needed to write off the debt of Wriggler as irrecoverable?

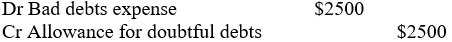

A)

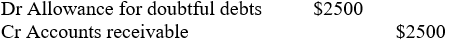

B)

C)

D) None of the answers provided

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Management uses the ageing approach method to

Q19: The balance in the Allowance for doubtful

Q20: Griffin Ltd made a sale of $800

Q21: Wrigley Ltd uses subsidiary ledgers for debtors

Q22: Wrigley Ltd uses subsidiary ledgers for debtors

Q23: A credit balance in a customer's account

Q24: The trial balance of Allen Ltd at

Q25: Which of the following is NOT a

Q26: The trial balance of Anderson Ltd included

Q29: S Ltd has the following balance sheet