Multiple Choice

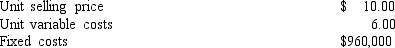

Vest Food Co.has the following operating data:

The company is contemplating moving to another state where direct labor costs can be reduced,thereby reducing the unit variable cost by 10%.The state where the company currently operates has offered to reduce property taxes to encourage Vest to stay.The minimum amount of property tax savings necessary to keep the company,assuming no other changes,would be

A) $152,016.

B) $240,000.

C) $208,696.

D) $125,217.

Correct Answer:

Verified

Correct Answer:

Verified

Q83: If fixed costs are $300,000 and variable

Q93: If a business had a capacity of

Q94: As production increases,what would you expect to

Q95: For the current year ending January 31,Ringo

Q96: If fixed costs are $500,000 and the

Q97: If fixed costs are $600,000 and the

Q99: If fixed costs are $750,000 and variable

Q101: Given the following cost and activity observations

Q102: For the past year,LaPrade Company had fixed

Q105: If a business had sales of $4,000,000,fixed