Essay

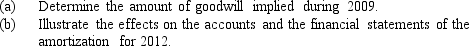

During 2009,Lexie,Inc.acquired Lena,Inc.for $10,000,000.The fair market value of the net assets of Lena,Inc.was $8,500,000 on the date of purchase.During 2012,Lexie,Inc.determined the goodwill resulting from the Lena acquisition was impaired and had a value of $1,000,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: The Drilling Company purchased a mining site

Q67: If an asset is discarded,a loss is

Q68: Goodwill is<br>A)amortized similar to other intangibles.<br>B)only written

Q69: Computer equipment was acquired at the beginning

Q70: Identify each of the following expenditures as

Q72: A machine was purchased for $60,000.It has

Q73: A current asset account must be increased

Q74: Goodwill equals the purchase price of a

Q75: Land improvements include<br>A)fences.<br>B)trees and shrubs.<br>C)outdoor lighting.<br>D)All of

Q76: Residual value is ignored under double-declining-balance depreciation