Multiple Choice

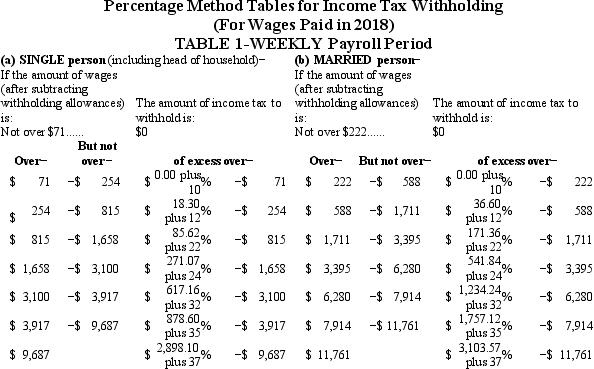

Olga earned $1,558.00 during the most recent weekly pay period.She is single with 2 withholding allowances and no pre-tax deductions.Using the percentage method,compute Olga's federal income tax for the period.(Do not round intermediate calculations.Round final answer to 2 decimal places. )

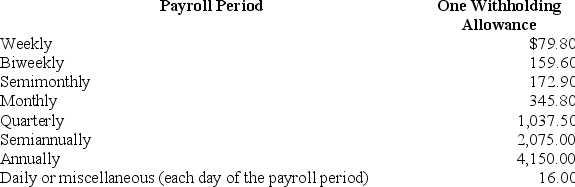

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A) $217.93

B) $239.25

C) $213.97

D) $214.75

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Federal income tax, Medicare tax, and Social

Q59: Which of the following states do not

Q60: The factors that determine an employee's federal

Q61: Why do employers use checks as an

Q62: From the employer's perspective,which of the following

Q63: Natalia is a full-time exempt employee who

Q65: Adam is a part-time employee who earned

Q66: Maile is a full-time exempt employee in

Q67: Andie earned $680.20 during the most recent

Q69: Which of the following is true about