Multiple Choice

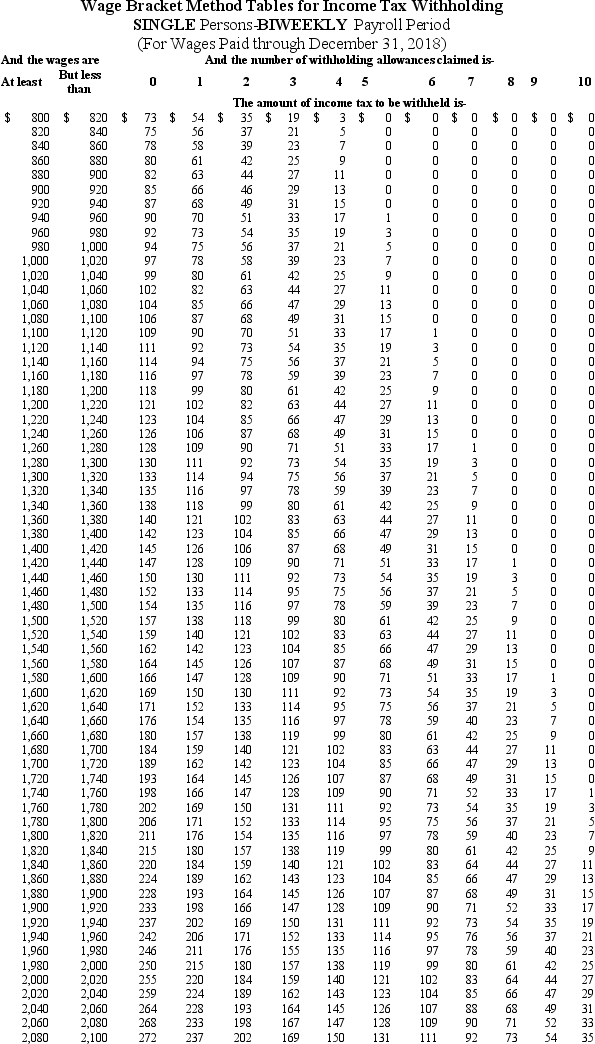

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period.She is single with 1 withholding allowance and both lives and works in Maryland.Assuming that she had no overtime,what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables.Maryland state income rate is 2.0%.Round final answer to 2 decimal places. )

A) $84.25

B) $94.80

C) $95.95

D) $100.78

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Charitable contributions are an example of post-tax

Q18: The wage-bracket of determining federal tax withholding

Q25: What role does the employer play regarding

Q26: Brent is a full-time exempt employee in

Q27: Why might an employee elect to have

Q28: The annual payroll tax guide that the

Q30: Janna is a salaried nonexempt employee in

Q33: What is an advantage of direct deposit

Q33: Julio is single with 1 withholding allowance.He

Q34: Renee is a salaried exempt employee who