Multiple Choice

Collin is a full-time exempt employee in Juneau,Alaska,who earns $135,000 annually and has not yet reached the Social Security wage base.He is single with 1 withholding allowance and is paid semimonthly.He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25,respectively.Collin has a child support garnishment of $300 per pay period.What is his net pay? (Use the percentage method.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

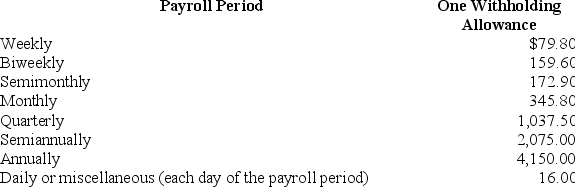

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

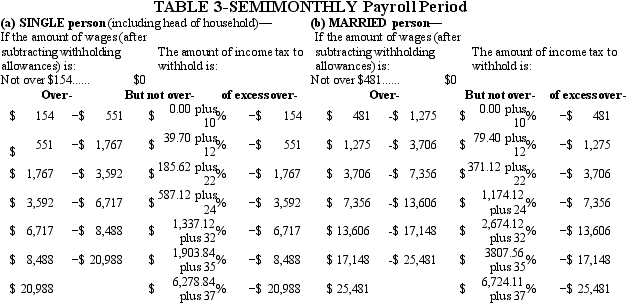

Federal Income tax using percentage method

A) $3,653.05

B) $3,613.28

C) $3,974.60

D) $3,885.14

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Social Security tax has a wage base,

Q32: Jeannie is an adjunct faculty at a

Q36: A firm has headquarters in Indiana,but has

Q37: Nickels Company is located in West Virginia

Q39: Manju is a full-time exempt employee living

Q40: How are income taxes and FICA taxes

Q43: Disposable income is defined as:<br>A)An employee's net

Q44: The purpose of paycards as a pay

Q45: What payroll-specific tool is used to facilitate

Q46: State and Local Income Tax rates _.<br>A)exist