Multiple Choice

Fred and Barney started a partnership.During Year 1,Fred invested $20,000 in the business and Barney invested $32,000.The partnership agreement called for each partner to receive an annual distribution equal to 15% of his capital contribution.Any further earnings were to be retained in the business and divided equally between the partners.The partnership reported net income of $38,000 during Year 1.How will the $38,000 of net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income. )

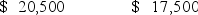

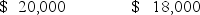

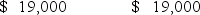

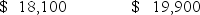

Fred Barney

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Preferred stockholders generally have no voting rights

Q15: A distribution by a sole proprietorship to

Q16: For Year 2,the Sacramento Corporation had beginning

Q17: Weller Corporation issued 10,000 shares of no-par

Q18: How is treasury stock reported on a

Q20: Which of the following is a disadvantage

Q21: Which of the following statements about par

Q22: Which of the following terms designates the

Q23: Blair Scott started a sole proprietorship by

Q24: Flagler Corporation shows a total of $660,000