Multiple Choice

On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.

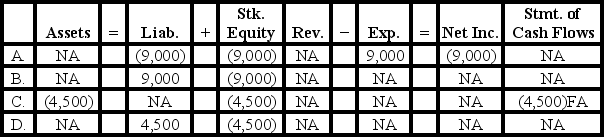

-How will the entry to record the declaration of the dividend on March 1 affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Rocco Corporation decides to issue a 7.5%

Q65: Montana Company was authorized to issue 200,000

Q66: An advantage of the corporate form of

Q67: What is meant by the term "double

Q68: Franklin Corporation reported net income of $75,000

Q70: Which of the following describes,in part,how the

Q71: All corporations are subject to extensive government

Q72: Ben Weaver is planning to invest in

Q73: When a corporation records a stock dividend,it

Q74: Curtain Co.paid dividends of $6,000,$12,000,and $20,000 during