Multiple Choice

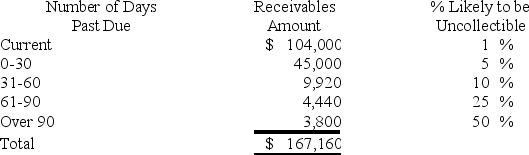

Domino Company ages its accounts receivable to estimate uncollectible accounts expense.Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $76,500 and $5,800,respectively.During Year 2,the company wrote off $4,640 in uncollectible accounts.In preparation for the company's estimate of uncollectible accounts expense for Year 2,Domino prepared the following aging schedule:

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A) $6,132

B) $1,512

C) $7,292

D) $4,640

Correct Answer:

Verified

Correct Answer:

Verified

Q32: When is it acceptable to use the

Q33: If a company estimates uncollectible accounts based

Q34: [The following information applies to the questions

Q35: Elliston Company accepted credit card payments for

Q36: When an uncollectible account receivable is written

Q38: With the direct write-off method,writing off an

Q39: The collection of an account receivable is

Q40: Which of the following is (are)the term(s)used

Q41: [The following information applies to the questions

Q42: Rhodes Company reports the following information for