Multiple Choice

Gotham City acquires $25,000 of inventory on November 1,20X7,having held no inventory previously.On December 31,20X7,the end of Gotham City's fiscal year,a physical count shows $8,000 still in stock.During 20X8,$6,500 of this inventory is used,resulting in a $1,500 remaining balance of supplies on December 31,20X8.

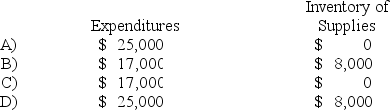

-Based on the preceding information,which of the following would be the correct account balances for 20X7 if Gotham City used the purchase method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The following information pertains to property taxes

Q41: Which of the following items is not

Q42: The general ledger of Broadway contains the

Q43: Which combination of fund and measurement basis

Q44: All of the following are elements of

Q46: Goshen City acquires $36,000 of inventory on

Q47: Which of the following funds are classified

Q48: Revenues from parking meters and parking fines

Q49: When an internal service fund (ISF)enters into

Q50: Gotham City acquires $25,000 of inventory on