Multiple Choice

In the AD partnership,Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio,respectively.They decide to admit David to the partnership.Each of the following questions is independent of the others.

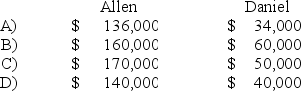

-Refer to the information provided above.David directly purchases a one-fifth interest by paying Allen $34,000 and Daniel $10,000.The land account is increased before David is admitted.What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q24: In the AD partnership,Allen's capital is $140,000

Q25: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q26: In the AD partnership,Allen's capital is $140,000

Q27: In the AD partnership,Allen's capital is $140,000

Q28: In the RST partnership,Ron's capital is $80,000,Stella's

Q30: The JPB partnership reported net income of

Q31: The SRT partnership agreement specifies that partnership

Q32: Which of the following statements best describes

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q34: Which of the following accounts could be