Multiple Choice

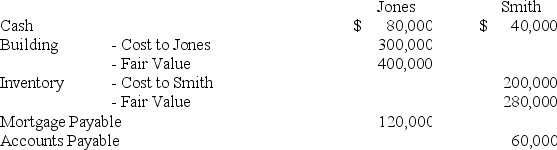

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

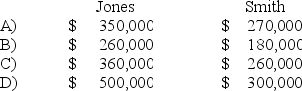

-Refer to the above information.What is each partner's tax basis in the Jones and Smith partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q50: The partnership of X and Y shares

Q51: In the AD partnership,Allen's capital is $140,000

Q52: The ABC partnership had net income of

Q53: Jones and Smith formed a partnership with

Q54: In the JK partnership,Jacob's capital is $140,000,and

Q56: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q57: When a new partner is admitted into

Q58: In the AD partnership,Allen's capital is $140,000

Q59: Which of the following observations is true

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the