Essay

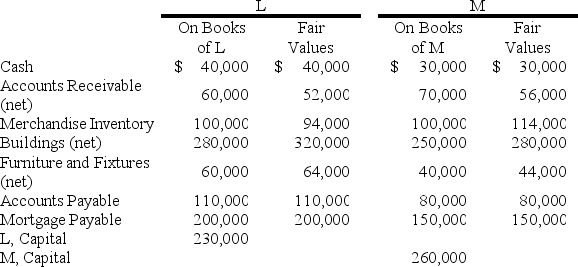

Two sole proprietors,L and M,agreed to form a partnership on January 1,20X9.The trial balance for each proprietorship is shown below as of January 1,20X9.

The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1,20X9.

Required:

a)Prepare a balance sheet,for financial accounting purposes,for the LM partnership as of January 1,20X9.

b)In addition,assume that M agreed to recognize the goodwill generated by L's business.Accordingly,M agreed to recognize an amount for L's goodwill such that L's capital equaled M's capital on January 1,20X9.Given this alternative,how does the balance sheet prepared for requirement A change?

Correct Answer:

Verified

a)

b)

Assets change due to the additi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b)

Assets change due to the additi...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Which of the following observations is true

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q61: In the ABC partnership (to which Daniel

Q62: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q63: In the JK partnership,Jacob's capital is $140,000,and

Q64: Which of the following accounts could be

Q66: Griffin and Rhodes formed a partnership on

Q67: In the JK partnership,Jacob's capital is $140,000,and

Q68: When a new partner is admitted into

Q69: In the RST partnership,Ron's capital is $80,000,Stella's