Multiple Choice

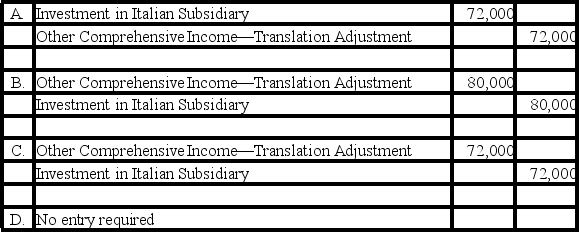

Dover Company owns 90% of the capital stock of a foreign subsidiary located in Italy.Dover's accountant has just translated the accounts of the foreign subsidiary and determined that a debit translation adjustment of $80,000 exists.If Dover uses the fully adjusted equity method for its investment,what entry should Dover record in order to recognize the translation adjustment?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Simon Company has two foreign subsidiaries.One is

Q42: On January 2,20X8,Polaris Company acquired a 100%

Q43: Michigan-based Leo Corporation acquired 100 percent of

Q44: The balance in Newsprint Corp.'s foreign exchange

Q45: The gain or loss on the effective

Q47: Seattle,Inc.owns an 80 percent interest in a

Q48: Dividends of a foreign subsidiary are translated

Q49: The British subsidiary of a U.S.company reported

Q50: South Company is a subsidiary of Pole

Q51: The British subsidiary of a U.S.company reported