Multiple Choice

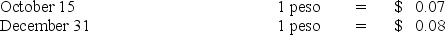

On October 15,20X1,Planet Company sold inventory to Stars Corporation,its Mexican subsidiary.The goods cost Planet $2,700 and were sold to Stars for $3,500,payable in Mexican pesos.The goods are still on hand at the end of the year on December 31.The Mexican peso is the functional currency of Stars.The exchange rates follow:

-Based on the preceding information,what amount of unrealized intercompany gross profit is eliminated in preparing the consolidated financial statements for the year?

A) $0

B) $800

C) $1,000

D) $1,300

Correct Answer:

Verified

Correct Answer:

Verified

Q31: On January 1,20X8,Pullman Corporation acquired 75 percent

Q32: Stack Company is a subsidiary of Pile

Q33: On October 15,20X1,Planet Company sold inventory to

Q34: On January 2,20X8,Polaris Company acquired a 100%

Q35: On January 1,20X8,Pace Company acquired all of

Q37: Park Co.'s wholly-owned subsidiary,Schnell Corp. ,maintains its

Q38: The balance in Newsprint Corp.'s foreign exchange

Q39: Prepare a schedule providing a proof of

Q40: Which of the following describes a situation

Q41: Simon Company has two foreign subsidiaries.One is