Multiple Choice

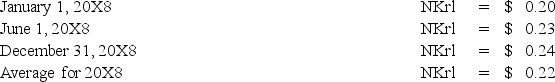

On January 1,20X8,Pullman Corporation acquired 75 percent interest in Steamship Company for $300,000.Steamship is a Norwegian company.The recording currency is the Norwegian kroner (NKr) .The acquisition resulted in an excess of cost-over-book value of $25,000 due solely to a patent having a remaining life of 5 years.Pullman uses the fully adjusted equity method to account for its investment.Steamship's December 31,20X8,trial balance has been translated into U.S.dollars,requiring a translation adjustment debit of $8,000.Steamship's net income translated into U.S.dollars is $35,000.It declared and paid an NKr 20,000 dividend on June 1,20X8.Relevant exchange rates are as follows:

Assume the kroner is the functional currency.

Assume the kroner is the functional currency.

-Based on the preceding information,in the journal entry to record the amortization of the patent for 20X8 on the parent's books,Investment in Steamship Company will be debited for:

A) $5,000

B) $5,500

C) $4,500

D) $3,000

Correct Answer:

Verified

Correct Answer:

Verified

Q56: All of the following stockholders' equity accounts

Q57: The assets listed below of a foreign

Q58: On January 2,20X8,Polaris Company acquired a 100%

Q59: Michigan-based Leo Corporation acquired 100 percent of

Q60: Saltaire Co.is a French company located in

Q62: When the local currency of a foreign

Q63: Which of the following defines a foreign-based

Q64: On January 2,20X8,Polaris Company acquired a 100%

Q65: Which combination of accounts and exchange rates

Q66: Barcode Corporation acquired 70% of the common