Essay

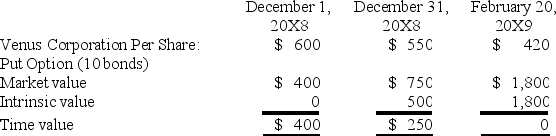

On December 1,20X8,Merry Corporation acquired 10 deep discount bonds of Venus Corporation at a cost of $600 per bond.Merry classifies them as available-for-sale securities.On this same date,it decides to hedge against a possible decline in the value of the securities by purchasing,at a cost of $400,an at-the-money put option to sell the 10 bonds at $600 per bond.The option expires on February 20,20X9 and is properly designated as a hedge at the time of purchase.Selected information concerning the fair values of the investment and the options follow:

Assume that Merry exercises the put option and sells Venus shares on February 20,20X9.

Required:

1.Prepare the entries required on December 1,20X8,to record the purchase of the Venus bonds and the put options.

2.Prepare the entries required on December 31,20X8,to record the change in intrinsic value and time value of the options,as well as the revaluation of the available-for-sale securities.

3.Prepare the entries required on February 20,20X8,to record the exercise of the put option and the sale of the securities at that date.

Correct Answer:

Verified

NOTE: because the stated purpo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Which of the following observations is true

Q7: On December 1,20X8,Denizen Corporation entered into a

Q8: Taste Bits Inc.purchased chocolates from Switzerland for

Q9: Company X denominated a December 1,20X9,purchase of

Q10: Taste Bits Inc.purchased chocolates from Switzerland for

Q12: On December 1,20X8,Hedge Company entered into a

Q13: Mint Corporation has several transactions with foreign

Q14: Suppose the direct foreign exchange rates in

Q15: On March 1,20X8,Wilson Corporation sold goods for

Q16: Quantum Company imports goods from different countries.Some