Multiple Choice

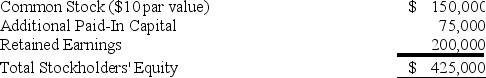

Peacoat Corporation acquired 80 percent of Sweater Corporation's common stock on March 31,20X4 for $360,000.At that date,the fair value of the noncontrolling interest was $90,000.On January 1,20X4,Sweater reported the following stockholders' equity balances:

Sweater reported net income of $100,000 in 20X4,earned uniformly throughout the year,and declared and paid dividends of $40,000 on December 31,20X4.Peacoat reported retained earnings of $500,000 on January 1,20X8,and had 20X4 income of $200,000 from its separate operations.Peacoat paid dividends of $50,000 on December 31,20X4.Peacoat accounts for its investment in Sweater Corporation using the fully adjusted equity method.

Sweater reported net income of $100,000 in 20X4,earned uniformly throughout the year,and declared and paid dividends of $40,000 on December 31,20X4.Peacoat reported retained earnings of $500,000 on January 1,20X8,and had 20X4 income of $200,000 from its separate operations.Peacoat paid dividends of $50,000 on December 31,20X4.Peacoat accounts for its investment in Sweater Corporation using the fully adjusted equity method.

-Based on the information provided,what is the consolidated income to the controlling interest reported for the year 20X4?

A) $275,000

B) $280,000

C) $260,000

D) $200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following information comes from Torveson Company's

Q2: On January 1,20X8,Putter Corporation acquired 40 percent

Q4: Pappas Company owns 85 percent of Sunny

Q5: On January 1,20X8,Putter Corporation acquired 40 percent

Q6: Company P holds 70 percent of the

Q7: Plexis Corporation holds 70 percent of Solar

Q8: Pure Life Corporation has just finished preparing

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q10: Pain Corporation holds 90 percent of Soothing

Q11: On July 1,20X8,Pair Logic Corporation acquires 75