Essay

On January 1,20X7,Pepper Company acquired 90 percent of the outstanding common stock of Salt Corporation for $1,242,000.On that date,the fair value of noncontrolling interest was equal to $138,000.The entire differential was related to land held by Salt.At the date of acquisition,Salt had common stock outstanding of $520,000,additional paid-in capital of $200,000,and retained earnings of $540,000.During 20X7,Salt sold inventory to Pepper for $440,000.The inventory originally cost Salt $360,000.By year-end,30 percent was still in Pepper' ending inventory.During 20X8,the remaining inventory was resold to an unrelated customer.Both Pepper and Salt use perpetual inventory systems.

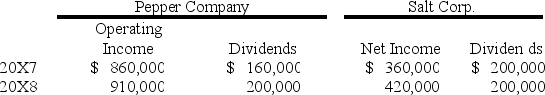

Income and dividend information for both Pepper and Salt for 20X7 and 20X8 are as follows:

Assume Pepper uses the cost method to account for its investment in Salt.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Correct Answer:

Verified

a.

Basic consolidation entry:

Dividen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Basic consolidation entry:

Dividen...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Pole Corporation owns 65 percent of Stick

Q50: Pirate Corporation acquired 85 percent of Ship

Q51: When there are intercompany sales of inventory

Q52: Sub Company sells all its output at

Q53: Sub Company sells all its output at

Q55: Which of the following are examples of

Q56: Pink Corporation owns 80 percent of Sink

Q57: Pepper Corporation owns 75 percent of Salt

Q58: On January 1,20X1,Picture Company acquired 70 percent

Q59: On January 1,20X7,Pepper Company acquired 90 percent