Multiple Choice

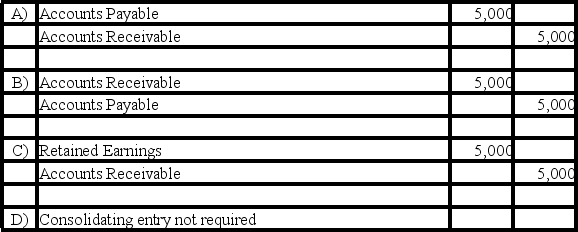

On January 1,20X8,Piano Company acquired all of Song Corporation's voting shares for $280,000 cash.On December 31,20X9,Song owed Piano $5,000 for services provided during the year.When consolidated financial statements are prepared for 20X9,which entry is needed to eliminate intercompany receivables and payables in the consolidation worksheet?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q24: On July 1,20X9,Playa Corporation paid $340,000 for

Q25: On December 31,20X1,Pine Corporation acquired 100 percent

Q26: Paccu Corporation acquired 100 percent of Sallee

Q27: Paris,Inc.holds 100 percent of the common stock

Q28: Plant Company acquired all of Sprout Corporation's

Q30: On January 1,20X8,Patriot Company acquired 100 percent

Q31: On January 1,20X9,Paradox Company acquired all of

Q32: Paris,Inc.holds 100 percent of the common stock

Q33: On December 31,20X8,Polaris Corporation acquired 100 percent

Q34: On January 1,20X8,Patriot Company acquired 100 percent