Essay

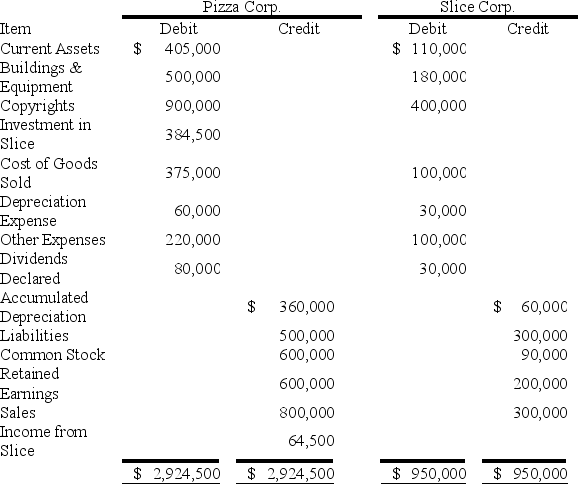

Pizza Corporation acquired 100 percent of Slice Company on January 1,20X5,for $350,000.Following are selected account balances from Pizza and Slice Corporation as of December 31,20X5:

Additional Information:

On January 1,20X5 the fair market value of Slice's assets equaled their book value with the exception of Plant Assets (with an estimated economic life of 6 years)which had a fair market value in excess in Slice's depreciable assets of $33,000.

Pizza used the equity method in accounting for its investment in Slice.

Detailed analysis of receivables and payables showed that Slice owed Pizza $10,000 on December 31,20X5.

Required:

a.Give all journal entries recorded by Pizza with regard to its investment in Slice during 20X5.

b.Give all consolidating entries needed to prepare a full set of consolidated financial statements for 20X5.

c.Prepare a three-part consolidation worksheet as of December 31,20X5.

Correct Answer:

Verified

a.

Equity Method Entries on Pizza's Book...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Equity Method Entries on Pizza's Book...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Pace Corporation acquired 100 percent of Spin

Q12: Paccu Corporation acquired 100 percent of Sallee

Q13: Paris,Inc.holds 100 percent of the common stock

Q14: Pace Corporation acquired 100 percent of Spin

Q15: On January 1,20X8,Patriot Company acquired 100 percent

Q17: Company P acquires 100 percent of the

Q18: Which of the following observations is NOT

Q19: On December 31,20X8,Polaris Corporation acquired 100 percent

Q20: Paccu Corporation acquired 100 percent of Sallee

Q21: Puzzle Corporation acquired 100 percent of the