Multiple Choice

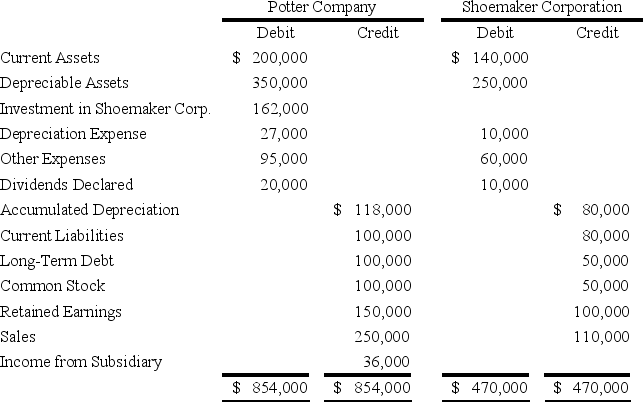

On January 1,20X8,Potter Corporation acquired 90 percent of Shoemaker Company's voting stock,at underlying book value.The fair value of the noncontrolling interest was equal to 10 percent of the book value of Shoemaker at that date.Potter uses the fully adjusted equity method in accounting for its ownership of Shoemaker.On December 31,20X9,the trial balances of the two companies are as follows:

-Based on the preceding information,what amount would be reported as total liabilities in the consolidated balance sheet at December 31,20X9?

A) $330,000

B) $712,000

C) $318,000

D) $130,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Pepper Company acquired 60 percent of the

Q2: ASC 805 is related to the Consolidation

Q3: On January 3,20X9,Pleat Company acquired 80 percent

Q4: Consolidated financial statements are required by GAAP

Q5: On January 3,20X9,Pine Company acquired 75 percent

Q7: On January 1,20X5,Playa Company acquires 90 percent

Q8: Which of the following usually does not

Q9: On January 1,20X9,Peanuts Corporation acquired 80 percent

Q10: On January 3,20X9,Pleat Company acquired 80 percent

Q11: Peta Corporation and its subsidiary reported consolidated