Multiple Choice

Two manufacturing business entities (A and B) were created at the same time this year and started operating on the very same day.They operate on two absolutely identical but separate worlds,but are not in competition with one another.They are absolutely identical in terms of their market success,their productive technology,equipment and infrastructure.They have the same headcount comprising the same categories of skills and competence.Both must pay cash for all their purchases.

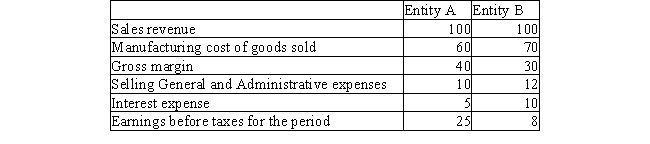

The first year's income statements for each firm are as follows:

Which of the following statements is entirely true:

A) Firm A uses straight line depreciation and has a larger shareholders' equity than B which uses accelerated depreciation

B) Firm A could invest more in R&D than firm B and has more debt than B does

C) Firm A uses accelerated depreciation while firm B uses straight-line depreciation

D) Firm A has less debt than firm B and has more efficient productive equipment

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Residual income is:<br>A) Income remaining after taxes

Q11: Firm A on 1 January X1 has

Q12: If you multiply sales profit margin by

Q13: Firms A and B have the same

Q14: Profit margin is defined as the ratio

Q16: Economic Value Added (EVA)is defined as follows<br>A)

Q17: If a business entity shows a high

Q18: All things being otherwise equal,when a business

Q19: Firm A on 1 January X1 has

Q20: The so-called 'DuPont formula' defines capital employed