Multiple Choice

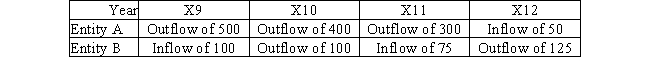

Two independent business entities A and B were created in X0.They are,today ,relatively similar in size and serve similar but separate markets.They report the following time series for their anticipated net cash flow from investing in both tangible and intangible investments (amounts expressed in CU) :

A) Entity B appears to be intent on growing faster than entity A.

B) Entity B appears to offer a lower risk to investors than entity A.

C) Entity A appears to be intent on growing faster than entity B.

D) Entity A demonstrates a better ability to reimburse its long-term debt than entity B.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A business entity is generating small operating

Q11: Which type of business entity is likely

Q12: Which of the four definitions offered best

Q13: How is the available cash flow calculated?<br>A)

Q14: The indirect method of calculation of the

Q15: Of the 4 strategies described below,which one

Q17: The primary impact of the timing difference

Q18: Outsourcing can improve the cash flow from

Q19: A business entity reports,for a complete accounting

Q20: A retailer is paid cash by its