Essay

On July 1,2019,Bobby's Building Corp.issued $1,000,000 of 11% bonds dated July 1,2019 for $1,062,771.The bonds were sold to yield 10% and pay interest semiannually on July 1 and January 1.Bobby's Building Corp.uses the effective interest method of amortization.The company's fiscal year ends on February 28.

Required:

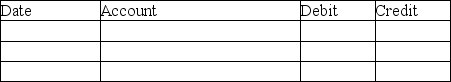

1.Prepare the journal entry on July 1,2019.

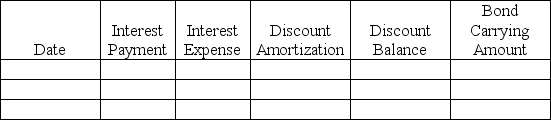

2.Prepare the amortization table for the first two interest periods.

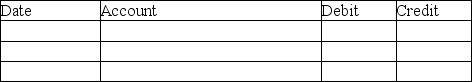

3.Prepare the journal entry on January 1,2020.

Round all amounts to the nearest dollar.Omit explanations for all journal entries.

1.

2.

2.

3.

3.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: On January 1,2019,Always Corporation issues $2,800,000,5-year,11% bonds

Q37: On January 1,2019,Tarantino Corporation issued $4,000,000,9%,5-year bonds

Q38: The carrying value of bonds decreases over

Q39: Cubs Corporation issues $550,000,10%,5-year bonds on January

Q40: The effective-interest method of amortizing a bond

Q42: A bond will sell at a premium

Q43: On January 1,2019,Paulsen Company issued $600,000,6%,5-year bonds

Q44: If,as part of the accounting for a

Q45: Unsecured bonds are called _.Secured bonds are

Q46: Which type of lease will NOT increase